Choosing the right FX broker is crucial for success in the foreign exchange market. With countless options available, traders must navigate the complexities of regulations, trading platforms, and broker services. Among the many choices, one can find platforms like fx broker Exness Benin that cater to specific regions and offer valuable services. This article will serve as a detailed guide on how to select the best FX broker for your trading needs.

Understanding FX Brokers

FX brokers act as intermediaries between traders and the foreign exchange market, facilitating the buying and selling of currency pairs. While some brokers operate as market makers, others are classified as ECN (Electronic Communication Network) or STP (Straight Through Processing), providing different trading experiences. Traders should understand these distinctions to identify the best fit for their trading strategy.

Key Features to Look for in an FX Broker

When choosing an FX broker, consider the following essential features:

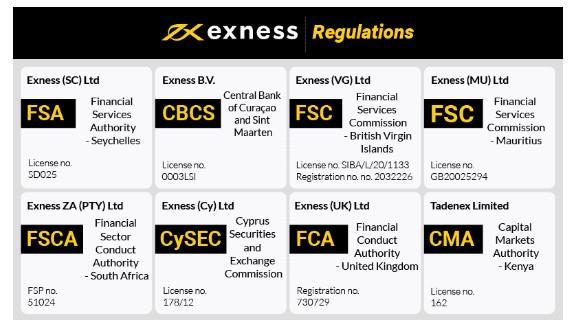

- Regulatory Compliance: Ensure the broker is regulated by a reputable authority (e.g., FCA, ASIC, CySEC). Regulatory compliance offers a level of protection for your funds and ensures fair trading practices.

- Trading Platform: The trading platform should be user-friendly, reliable, and offer advanced tools for analysis. Popular platforms like MetaTrader 4 and MetaTrader 5 are well-regarded in the trading community.

- Account Types: Look for brokers that offer various account types to suit different trading styles and capital levels. Consider spreads, leverage, and minimum deposit requirements.

- Customer Support: A responsive customer service team is vital for addressing any issues that may arise during trading. Check availability via live chat, phone, or email.

- Educational Resources: For beginners, brokers that provide educational content, tutorials, and webinars can be particularly beneficial for building trading skills.

Understanding Different Account Types

Most FX brokers offer multiple account types designed for various trading preferences. Here’s a breakdown of common account types:

- Standard Accounts: Generally suitable for most traders, offering competitive spreads and access to a wide range of currency pairs.

- Mini Accounts: These accounts require lower minimum deposits, making them ideal for beginners looking to trade with smaller amounts of capital.

- VIP Accounts: Targeted at experienced traders, these accounts typically offer lower spreads and higher leverage, catering to those who trade with substantial amounts.

- Islamic Accounts: For Muslim traders, brokers often offer Islamic accounts that comply with Sharia law by eliminating interest on overnight positions.

Regulation and Safety

Regulation is perhaps the most critical aspect of selecting an FX broker. Established regulatory bodies impose stringent standards on brokers to promote transparency and ensure the security of traders’ funds. The Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) are among the most respected regulators. Be cautious of unregulated brokers, as trading with them poses significant risks, including the potential loss of your capital.

Understanding Spreads and Commissions

Spreads refer to the difference between the buying and selling prices of a currency pair. A broker’s pricing model can significantly affect your trading profitability. Some brokers offer fixed spreads, while others have variable spreads. Variable spreads can change based on market conditions but may offer lower spreads during high liquidity periods. Additionally, some brokers charge commissions along with spreads, which can impact trading costs. Ensure that you understand these costs entirely before choosing a broker.

Leverage: Balancing Risk and Reward

Leverage allows traders to control larger positions than their initial capital would otherwise permit. While this can amplify profits, it also poses a significant risk. Regulation often dictates maximum leverage ratios, which can range from 1:30 for retail traders in the EU to 1:500 in some offshore jurisdictions. Risk management becomes even more critical when trading with high leverage, as losses can accumulate quickly.

Analysis Tools and Resources

An effective trading platform should provide various analytical tools and resources. Look for features such as:

- Charting Tools: These help you visualize price movements and identify patterns.

- Technical Indicators: Tools like moving averages, RSI, and MACD assist in making informed trading decisions.

- Market News: Access to up-to-date market news can provide context and help traders react promptly to market changes.

Conclusion

Selecting the right FX broker is a critical decision for any trader. By understanding the key features such as regulation, account types, trading platforms, and costs, you can make an informed decision tailored to your trading needs. Conduct thorough research, read reviews, and consider demo accounts to test the broker’s services before fully committing. An informed choice will set you on the path to success in the dynamic world of forex trading.